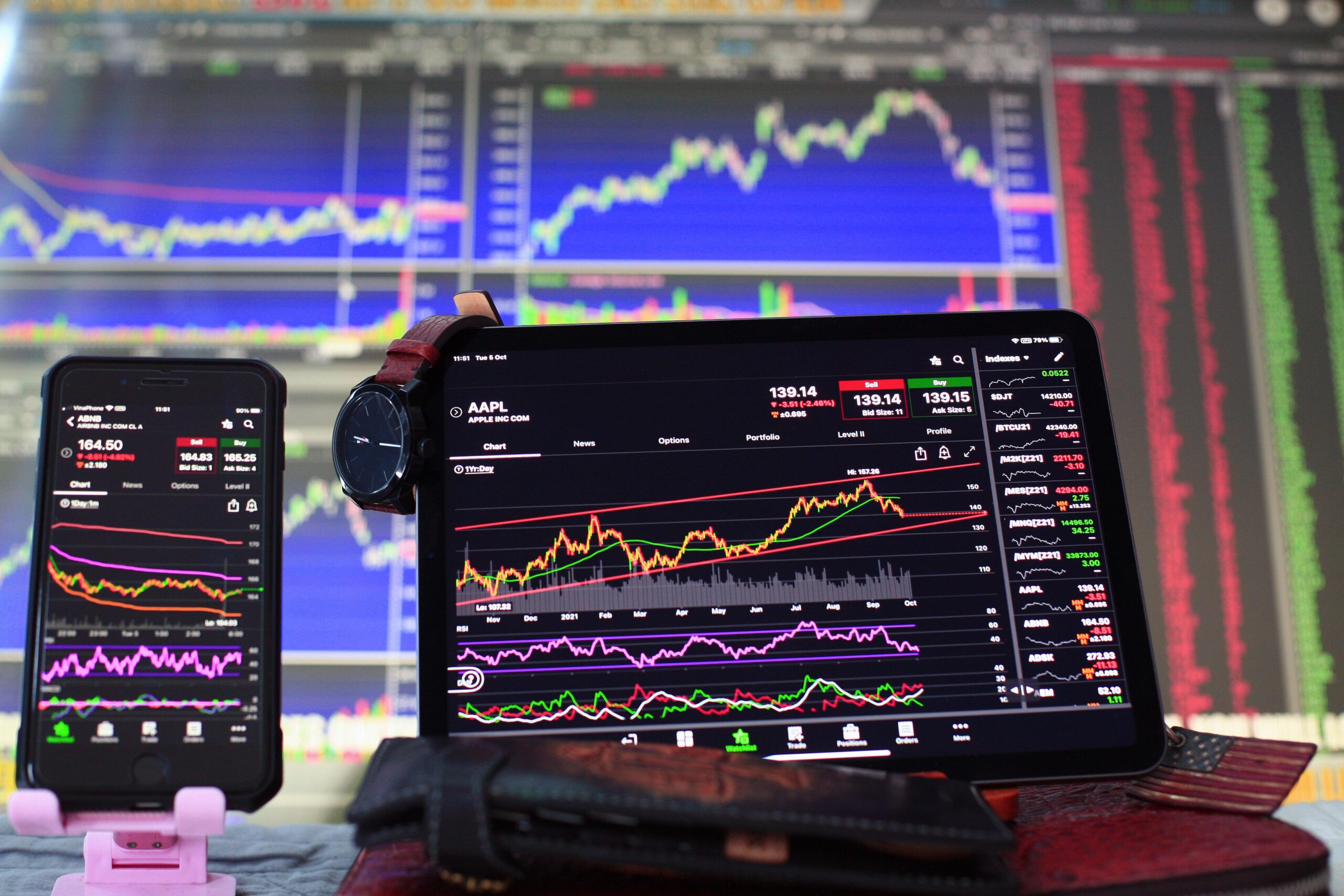

Trading can be an exciting and potentially profitable venture. However, it also comes with significant risks that can impact your financial stability and overall well-being. Understanding these risks and learning how to manage them is crucial for anyone considering entering the trading world.

Understanding Trading Risks

Market Risk

Volatility: Markets can be highly volatile, with prices fluctuating rapidly due to various factors like economic news, political events, and market sentiment. This unpredictability can lead to significant gains or losses.

Economic Factors: Interest rates, inflation, and economic indicators can influence market performance, affecting the value of your investments.

Leverage Risk

Magnified Losses: While leverage can amplify gains, it also magnifies losses. Trading on margin can lead to losing more than your initial investment, potentially putting you in debt.

Margin Calls: If your account equity falls below a certain level, you may receive a margin call, requiring you to deposit more funds or sell assets at an unfavorable time.

Liquidity Risk

Market Liquidity: In thinly traded markets, you might struggle to buy or sell assets at your desired price, leading to slippage and increased trading costs.

Asset Liquidity: Some assets may be difficult to sell quickly without impacting their market price, especially in times of market stress.

Psychological Risk

Emotional Decision-Making: Fear and greed can cloud your judgment, leading to impulsive decisions that deviate from your trading plan.

Stress and Health: The high-pressure environment of trading can lead to stress, affecting your mental and physical health over time.

Strategies to Manage Trading Risks

Education and Research

Continuous Learning: Stay informed about market trends, economic indicators, and trading strategies. Knowledge is your best defense against market unpredictability.

Set Clear Goals: Define your financial goals, risk tolerance, and time horizon. A clear plan helps you stay disciplined and focused.

Stick to Your Plan: Avoid making impulsive decisions based on short-term market movements. Follow your trading plan consistently.

Psychological Preparedness

Note: This blog post reflects my personal opinion and should not be considered financial advice. Always do your own research or consult with a professional before making trading decisions.

1 Comment

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a little bit, but other than that, this is fantastic blog. A great read. I’ll certainly be back.